The Fastest Growing and Declining E-Commerce Categories

The COVID-19 pandemic is having a significant impact on every aspect of life, including how people shop for their necessities, and their not-so-necessities.

With online retail sales estimated to reach an eye-watering $6.5 trillion by 2023, the ecommerce sector was already booming. But since the outbreak, online shopping has been catapulted into complete overdrive. Even the largest retailers on the planet are struggling to keep up with the unprecedented consumer demand—but what exactly are people buying?

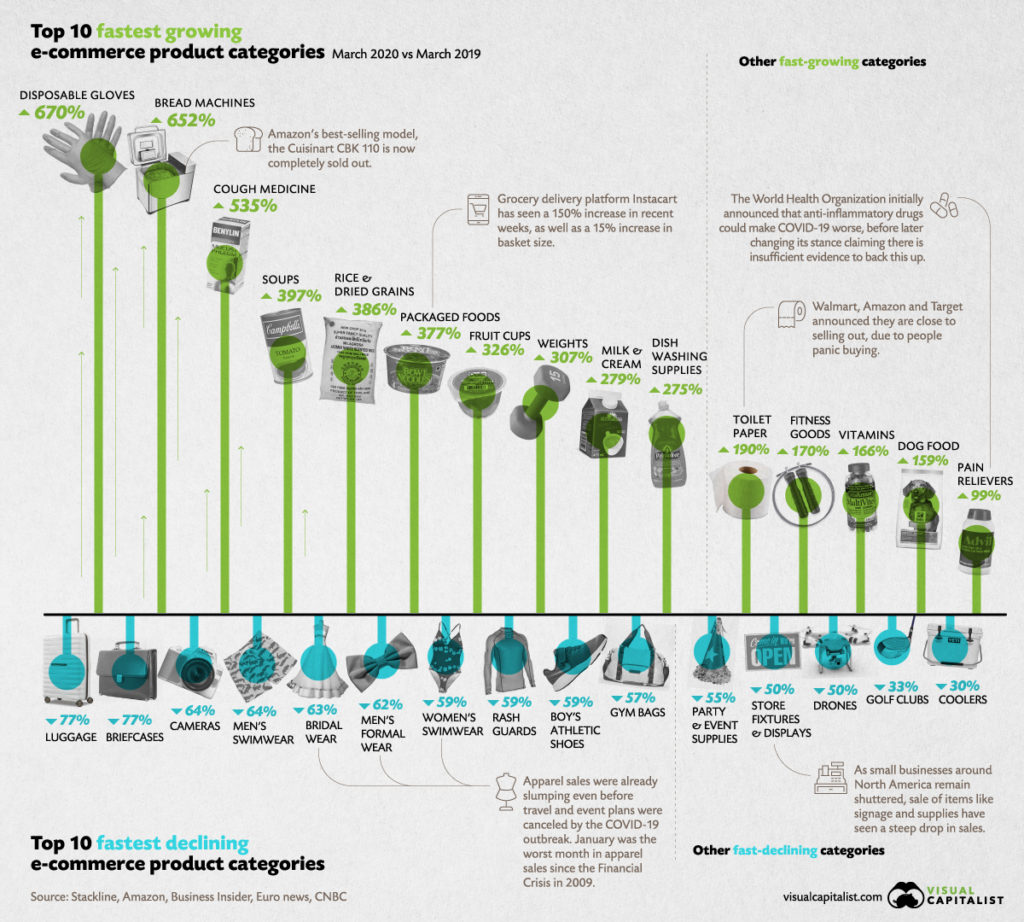

To answer this question, retail intelligence firm Stackline analyzed ecommerce sales across the U.S. and compiled a list of the fastest growing and declining ecommerce categories (March 2020 vs. March 2019) with surprising results.

The Frenzy of Buyer Behavior

As people come to terms with their new living situations, their buying behavior has adapted to suit their needs. While panic buying may have slowed in some countries, consumers continue to stock up on supplies, or “pandemic pantry products”.

Many consumers are also using their newfound time to focus on their health, with 85% of consumers taking up some kind of exercise while in social isolation, and 40% of them saying they intend to keep it up when restrictions are lifted.

These changing behaviors have resulted in a number of product categories experiencing a surge in demand — and although a lot of them are practical, others are wonderfully weird.

The Fastest Growing Categories

While the below list features several shelf-stable items, it seems as though consumers are taking matters into their own hands, with bread making machines sitting in second place and retailers selling out of their top models.

It’s clear from the list that consumers are considering positive changes to their lifestyle while in isolation, as fitness, smoking cessation, and respiratory categories are all experiencing growth.

Explore the top fastest growing product categories below:

| Rank | Category | % Change in March (2020 vs. 2019) |

|---|---|---|

| #1 | Disposable Gloves | 670% |

| #2 | Bread Machines | 652% |

| #3 | Cough & Cold | 535% |

| #4 | Soups | 397% |

| #5 | Dried Grains & Rice | 386% |

| #6 | Packaged Foods | 377% |

| #7 | Fruit Cups | 326% |

| #8 | Weight Training | 307% |

| #9 | Milk & Cream | 279% |

| #10 | Dishwashing Supplies | 275% |

Interestingly, toilet paper has seen more growth than baby care products, and cured meats have seen more growth than water. But while some categories are experiencing a drastic increase in demand, others are slumping in the pandemic economy.

The Fastest Declining Categories

An unprecedented wave of event and vacation cancellations is having a huge impact on the products people consume. For instance, luggage and suitcases, cameras, and men’s swimwear have all seen a dip in sales.

See fastest declining categories below:

| Rank | Category | % Change in March (2020 vs. 2019) |

|---|---|---|

| #1 | Luggage & Suitcases | -77% |

| #2 | Briefcases | -77% |

| #3 | Cameras | -64% |

| #4 | Men’s Swimwear | -64% |

| #5 | Bridal Clothing | -63% |

| #6 | Men’s Formal Wear | -62% |

| #7 | Women’s Swimwear | -59% |

| #8 | Rash Guards | -59% |

| #9 | Boy’s Athletic Shoes | -59% |

| #10 | Gym Bags | -57% |

Regardless of which list a product falls under, it is clear that the pandemic has impacted retailers of every kind in both positive and negative ways.

The New Normal?

Officially the world’s largest retailer, Amazon has announced it can no longer keep up with consumer demand. As a result, it will be delaying the delivery of non-essential items, or in some cases not taking orders for non-essentials at all.

This presents a double-edged sword, as the new dynamic that is bringing some retailers unprecedented demand could also bring about an untimely end for others.

Meanwhile, the question remains: will this drastic change in consumer behavior stabilize once we flatten the curve, or is this our new normal?