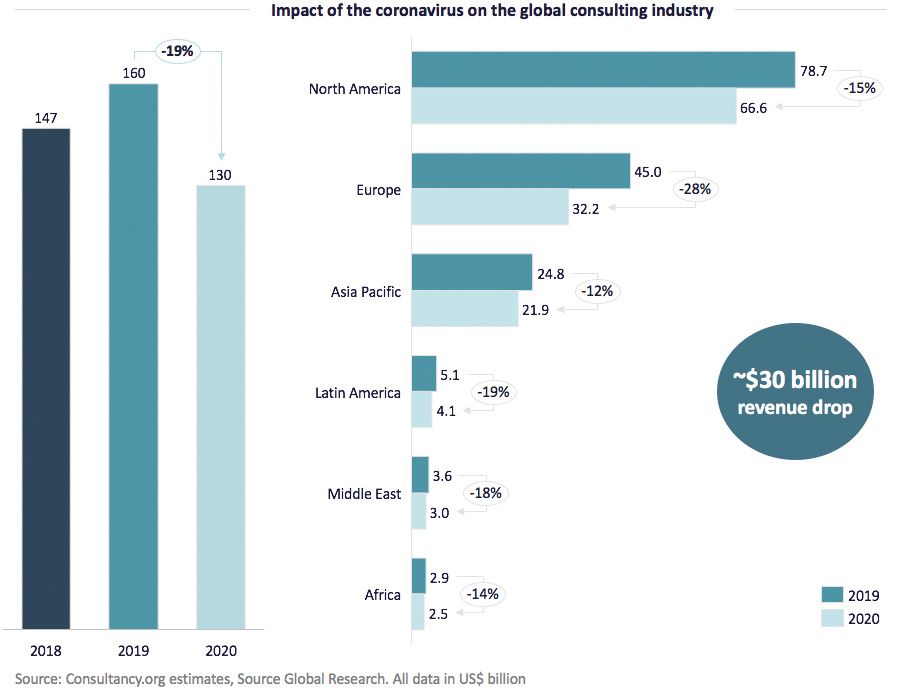

The coronavirus pandemic has already had a huge impact on economy in general – something which has of course had a knock-on impact on consulting. Just exactly how much of a dent on the industry’s growth Covid-19 has had is extremely difficult to tell, but in a new forecast researchers have tried to put a number to the damage, and have found global consulting could lose some $30 billion of value in 2020.

The global consulting industry has grown strongly in the 12 years since the last financial crisis. The planet’s consulting scene is now worth a combined $160 billion, but with the coronavirus having pushed many sluggish economies to the brink of a recession, clients are delaying projects, decreasing their scope or cancelling them all together. As a result, the revenue of consulting is taking a big hit.

To understand what this impact of this is likely to be, researchers from Source Global Research has gathered the views of hundreds of consulting firms from around the world. The group has subsequently estimated that Covid-19 could reduce the size of the consulting industry by 19%, from $160 billion in 2019 to $130 billion in 2020, with the second and third quarter of 2020 expected to be the worst periods for negative growth. While the good news is that Source anticipates a rapid recovery which will likely commence before the end of the year, there will be large variations across regions, countries, industries, and firm types.

Regional breakdown

The world’s largest national consulting market remains the US, which accounts for around half of global consulting demand. So far, the country has only seen a limited level of domestic disruption; but many believe it will quickly catch Europe’s larger Covid-19 cost. While consultants in the region are already taking precautionary steps to mitigate this, Source still anticipates that the North American market will shrink by more than most US and Canadian firms currently expect – possibly by as much as 15%.

On the other side of the Atlantic, feedback from firms in Europe has led Source to estimate that demand across the continent may fall by 28%. The large manufacturing base of German consulting will be particularly impacted by disrupted supply chains, and could shrink by more than this, along with Britain, where consulting is already experiencing its lowest growth in seven years, and forecasts have notably been downgraded because of Brexit. Italy, the current epicentre of the outbreak in the region, could fall even more sharply.

As was the case after the 2008 global financial crisis, Europe is likely to recover at a slower rate than the US, as American clients tend to show greater willingness to leverage consulting services, and adopt new technology in business. By comparison, Asia is likely to see the lowest impact of any region, due to how effective China was in containing its initial outbreak. As a result, clients in some parts of Asia Pacific are already looking beyond the crisis, albeit cautiously.

Elsewhere, Latin America is likely to be hit much harder than North America – enduring a drop of 19%. The Middle East is forecast to see a similar 18% shrinkage, while Africa will see its revenue fall by 14%.

Industries

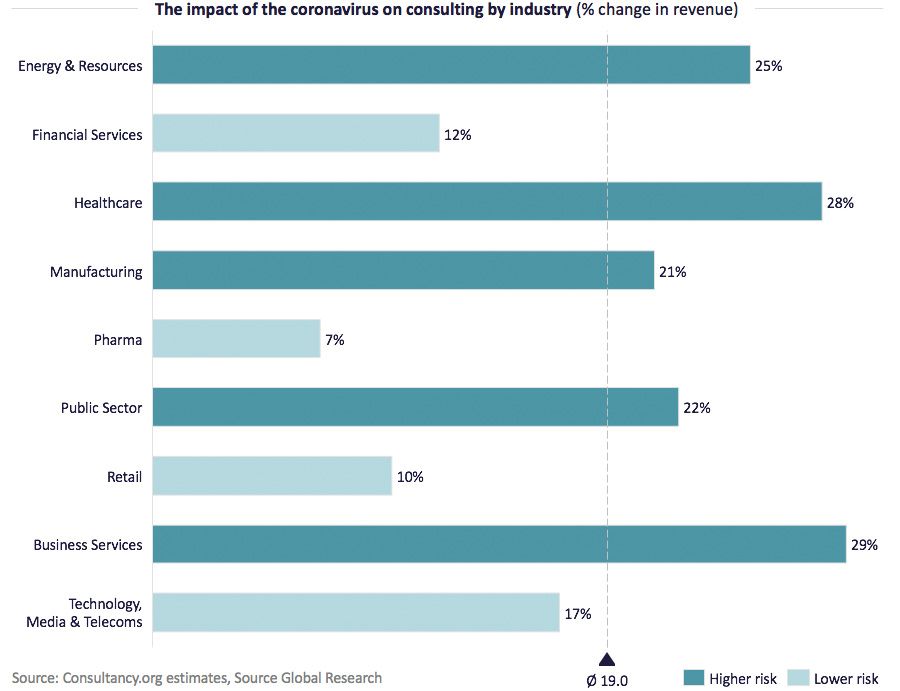

It is important to note that Source’s research features forecasts which are something of a worst-case scenario, and intended to be directional only in helping companies prepare for what may be to come. As with the virus’ spread, everything is changing very quickly, so predictions can and will inevitably change. With that being said, it is already clear that certain industries will not be able to weather the storm as well as others – and this will have a knock-on effect on the consultants offering services to these sectors.

The financial services sector is likely to fare better than most, but will still contract. Contrary to the financial crisis, when they were bailed out, most institutions have improved liquidity. As they are now better capitalized, banks have the buffers to play an active role in supporting the economy back to recovery, meaning banks will be deploying initiatives, and in a continued competitive environment they continue to invest heavily in digitization.

Firm types

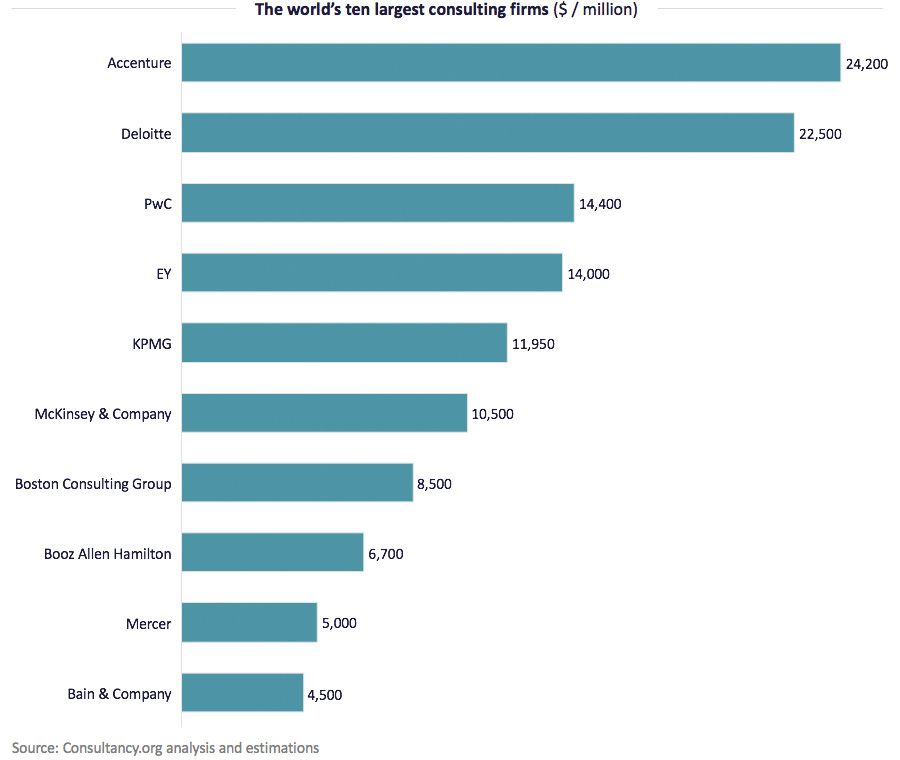

The exposure of individual firms will vary based on the services they provide and industries they serve. At a time like this, diversity and the ability to adapt will be critical. As a result, multi-faceted firms which cater to various clients will undoubtedly come out of this crisis in the strongest position. However, for firms of all sizes, the key challenge will be how effectively they can rebuild their pipelines and convert sales during what are likely to be at least two very challenging quarters.

The hardest-hit services will be those where the work involved involves time on clients’ site and travel. Having been booming until very recently, then, change-related work and many aspects of operational improvement are suddenly suffering – particularly in Europe. On the other hand, as the work is often done in the consulting firm’s office, strategy work will be less badly affected.

Another form of work to survive relatively unscathed will be long-term technology projects. Again, because so much of the work can be delivered remotely, this work can continue despite travel disruption. At the same time, as many of these long-term projects will have already begun, clients will be reluctant to shelve them at this point and lose the investment they’ve already made.

Again, this state of affairs will suit large firms best, as they tend to have the reputational clout to attract the biggest and longest projects, which clients are more reluctant to cancel. Brand recognition is a massive advantage at times like these; as was the case during the global financial crisis, clients will only invest in consulting during periods of economic upheaval if the work is delivered by a major firm. Meanwhile, smaller firms may further suffer as the market’s largest competitors can afford to cut their rates, eating into the market share of the challengers who had so recently disrupted the market with their lower costs.